SPRINGFIELD, KY — Washington County Elementary School hosted its second annual Multicultural Family Night last week. Students in grade levels …

The orange striped barrels are coming to roadways across Washington County. The county is slated to receive over $22 million dollars in road c…

On Friday, April 5, the Fayette County Coroner’s Office released the identity of the man who was shot and killed by Lexington police officers …

Each year, on Good Friday, the Spanish community of St. Dominic Catholic Church, present a reenactment of Christ’s last day before the crucifixion.

Two separate accidents involving motorcycles over Easter weekend sent two individuals to the hospital.

A Washington County jury awarded $170,000 to a man injured in a fall at Springfield’s Five Star gas station in 2020.

SPRINGFIELD, KY — Washington County High School sophomore Cambron “Cam” Wright recently visited Washington, D.C. for National Legislative Day …

The Latest

The Commanders baseball team traveled to Florida over spring break to compete in the annual Fort Walton Beach Bash.

SPRINGFIELD — In March, Washington County High School hosted a number of events for local students to prepare and educate them on life after h…

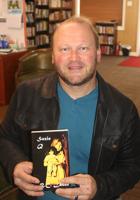

For local author, Brian Lauer, writing began as a coping mechanism when he became disabled b…

COLUMBIA, KY - Kentucky State Police Post 15 will be conducting periodic traffic safety chec…

FRANKFORT, KY – Secretary of State Michael Adams announced voter registration continues to s…

Scenes like this were common across the area last week following severe storms on Monday nig…