FRANKFORT — As a provision in HB 1, the Washington County Fiscal Court will receive $1.26 million for critical natural gas infrastructure upgr…

The Sun ran a story on April 3 about an inmate that jumped from a transport vehicle on her way to Lawrence County. The Washington County Sheri…

FRANKFORT, KY — Haydon Materials LLC, which made the lowest bid for the KY Highway 555 Parkway corridor project to the Kentucky Transportation…

Two separate accidents involving motorcycles over Easter weekend sent two individuals to the hospital.

In a tough decision that could have gone either way, the Washington County Planning Commission voted to deny SNS Rentals proposed subdivision of the property adjacent to Willisburg Community Park. In a special-called meeting of the Planning Commission on Wednesday, April 10, commissioners we…

Two distillery projects in Springfield are one step closer. The Springfield City Council approved annexation of the property on the corner of …

Washington County fiscal court rejected two bids to purchase county owned property off of Highway 55 and will instead ask for proposals from r…

The Latest

FRANKFORT — In a significant step forward for mental health reform in Kentucky, Gov. Andy Beshear has signed into law House Bill 385, known as…

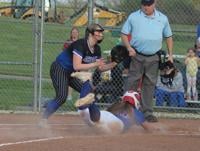

Washington County suffered a shutout loss as Nelson County pulled away to win 13-0 in five innings in a 19th District softball game on Monday,…

Washington County scored first but couldn’t maintain its early momentum as Campbellsville mo…

Washington County competed in the Thomas Nelson All-Comers Meet on Tuesday, April 9.

Washington County Little League opened for the season on Saturday, April 13, at Idle Hour Pa…

A Springfield man who refused to pull over for a Washington County Sheriff’s deputy was ulti…

FRANKFORT — With the support of Sen. Jimmy Higdon, R-Lebanon, and Rep. Kim King, R-Harrodsbu…